Starting a business is difficult, even under the best of circumstances.

But starting a business without access to banking services puts even the most well-funded start-up in a real bind.

That’s the situation facing many in the cannabis industry, even though California voters passed Proposition 64 — legalizing recreational use of marijuana for those 21 and older — by a wide margin and some have predicted the nascent cannabis market in the state may soon be worth $4 billion to $7 billion.

“It definitely needs a resolution,” said California state Treasurer John Chiang. “America operates on cash and credit. Most of the world operates on cash and credit. And here we have an industry (in which) the cash economy doesn’t work properly.”

Within weeks of Prop 64’s passage, Chiang formed the Cannabis Banking Working Group to try to clear up the uncertainty surrounding financing for legal marijuana businesses.

The group has met four times across the state since last December and its next stop is Friday at the Town and Country Hotel on Hotel Circle North in San Diego, at 9:30 a.m.

Representatives from the financial sector and the cannabis industry are scheduled to speak and the public is invited to attend.

So why do cannabis business owners have so much trouble getting banks to take their business?

Many financial institutions resist because marijuana is still illegal on the federal level. It’s listed by the U.S. Drug Enforcement Administration as a “Schedule I” drug — the same classification as LSD, ecstasy and heroin.

While the federal government allows banks to work with cannabis businesses in states that have passed laws approving recreational marijuana, banks still have to file suspicious activities reports in addition to following standard banking guidelines. That means extra costs.

And since the federal prohibition against marijuana is still in effect, banks fear they could be held criminally liable should a marijuana business run afoul of the law.

As a result, many cannabis businesses become an all-cash enterprises, with stories abounding of business people hauling duffel bags filled with cash, making them targets for robberies.

One of the solutions discussed by the working group is getting the federal government to respect the laws of states that have passed recreational marijuana laws.

Rep. Dana Rohrabacher, R-Huntington Beach, has introduced legislation on Capitol Hill that would prevent the feds from interfering with the “production, possession, distribution, dispensation, administration or delivery of marijuana” in states like California.

Rohrabacher will take part in Friday’s meeting in San Diego.

“We’re spending law enforcement dollars not on protecting people from criminals but instead to try to protect people from themselves, to prevent an adult from having smoking weed in their backyard,” Rohrabacher said in a telephone interview. “We’ve spent billions trying to stop that and it’s ridiculous.”

In 2014, the U.S. Department of Justice issued a memorandum called the Cole Memo that was designed to provide greater access between banks and the cannabis industry but Chiang said the disconnect remains.

“We want to put a road map in place as to how to address cannabis banking,” Chiang said. “It’s the biggest issue that’s been left unaddressed” since voters approved Prop 64 last November, 57 percent to 42 percent.

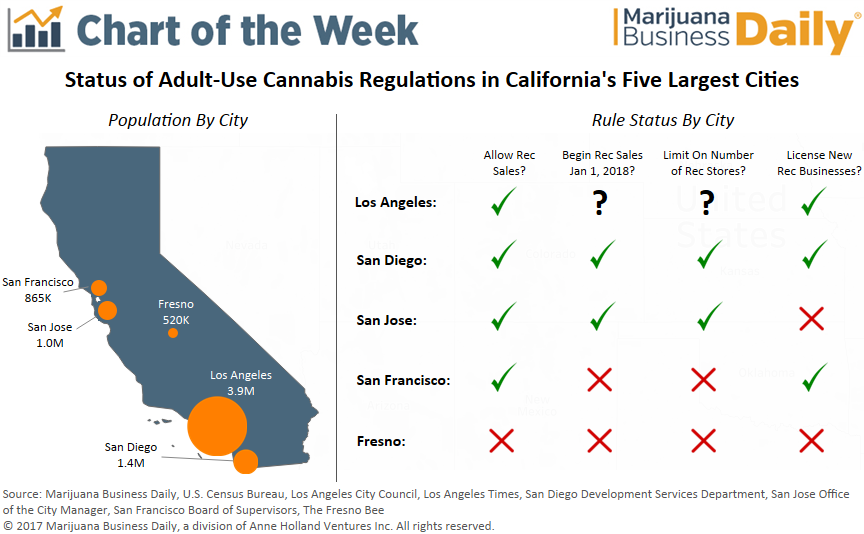

By statute, state officials are required to have a regulatory and taxation framework in place by Jan. 1, 2018.

“You can’t have what we have today and we can’t have (the banking situation) getting worse next year, where you have an incredible black market, where you have people operating underground,” Chiang said.

Chiang has written to California’s congressional delegation and President Trump, asking for guidance. U.S. Attorney General Jeff Sessions is a harsh critic of legalized marijuana.

Rohrabacher said Sessions “is an old friend of mine” but said time was on his side.

“As the cannabis industry gets legalized across more states, more and more members of Congress are finding themselves in a state where voters have legalized the medical or the adult use of marijuana,” Rhorabacher said.

“When your voters vote by a significant margin to make something legal … that’s something a lot of members of Congress are faced with right now and we’re actually picking up supporters over the years.”

credit:thecannifornian.com