If the legislative timeline holds, it will be possible for Canadians to legally buy marijuana by this time next year.

But as revealed by the news this week that a major Canadian clearing house may refuse to settle some share trades involving cannabis firms, far too many questions remain unanswered.

This chronic lack of clarity from Ottawa is the reason why Canadian Depository for Securities Ltd. (CDS) is worried about potential liabilities it would face if it facilitated a trade involving a pot-selling company that does business in the United States.

U.S. President Donald Trump seems intent on enforcing federal laws that prohibit the growing and selling of pot, in spite of the fact that more than two dozen states have legalized those practices for both medical and recreational use.

It’s not clear yet whether CDS will indeed refuse to settle trades involving some marijuana companies. It’s not even clear whether it has the right to do that.

But the CDS quandary is emblematic of the uncertainty that faces a new industry in which companies are jockeying for position at the starting gate when pot becomes legal in Canada. The provinces and their regulatory agencies are also in the dark about what to expect.

Here’s the basic question: What is the new recreational pot industry actually going to look like?

The proposed federal Cannabis Act covers a lot of ground when it comes to Ottawa’s responsibilities “respecting the importation, exportation, production, testing, packaging, labelling, storage, preservation, sale, distribution, possession, disposal or obtaining of or other dealing in cannabis or any class of cannabis.”

But the finer regulatory details haven’t been settled. As Queen’s University economist Allan Gregory put it in a recent article for Policy Options, the Cannabis Act doesn’t contain the rules for creating “a fair and orderly market.”

It falls to Health Canada to create that framework, and while the ministry does a respectable job with things like regulating medicines and food safety, it’s not known for its expertise in setting the rules for a large-scale commerce.

As a spate of recent incidents involving unauthorized fertilizers and other substances in medical-grade pot suggest, it’s not even clear that Health Canada can enforce quality control.

Then there’s the way the department handles and discloses information, and the question of whether it can adequately police insider trading and self-dealing.

Under its current remit, Health Canada collects huge amounts of market info. But as Prof. Gregory wrote, “these data requirements touch the entire industry, both publicly and privately held companies. I know of no other market where such a situation exists.”Under the federal law, Ottawa will have the right to release business-related information – even proprietary, confidential data – “if the Minister considers that the disclosure is necessary to protect public health or public safety.” This has to be a worry for companies that will be operating in a very competitive market.

Meanwhile, the provinces are scrambling to prepare for the new reality. They are the ones charged with the specifics of distribution and retail, and it is clear that they have varying levels of enthusiasm for the enterprise.

Some, like Quebec, are already warning they simply don’t have enough lead time to set up a comprehensive retail framework.

It’s entirely possible, even likely, that a number provinces and territories won’t be ready when the Cannabis Act goes into effect. As a result, it will be up to Health Canada to establish an interim federal distribution scheme.

The existing federal medical marijuana market, in which licensed medicinal users get their product via mail-order from approved producers, is the obvious template for a national recreational version. (It’s not an accident that many of the therapeutic growers are ramping up their operations in preparation of legalized recreational use.)

And yet much about the medicinal market, a relatively small industry involving 130,000 registered customers and fewer than 50 producers, remains haphazard.

There is no public disclosure as to how much medicinal cannabis producers are allowed to grow, or even how much they have in stock (this information is collected but not released).

And the granting of licenses is often announced on an ad hoc basis. Some would-be producers have complained they couldn’t get detailed reasons why their applications were rejected.

In this day and age, it is entirely appropriate for marijuana to be legal, provided it is properly regulated. It’s the latter bit that must be the focus of government’s attention for the next 12 months. There is still time to establish clear rules to create a fair, orderly and safe marketplace. But it will run out quickly.

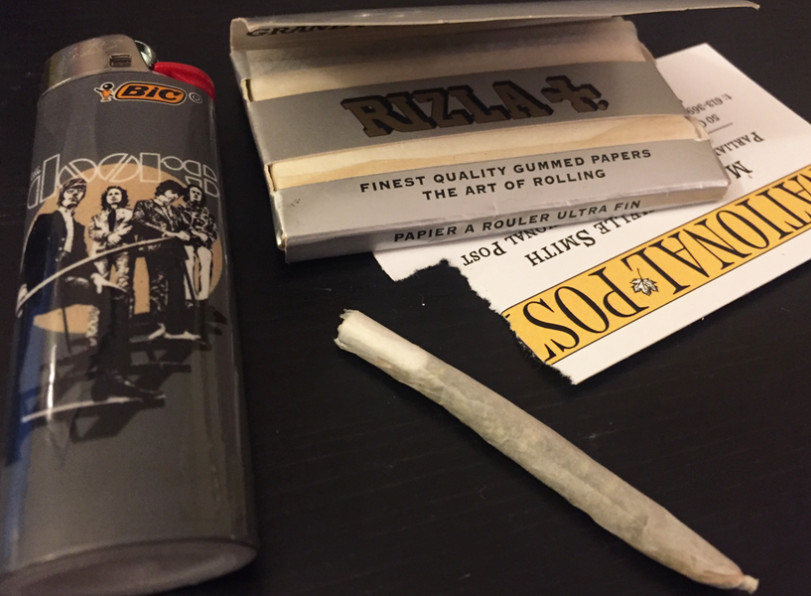

credit:420intel.com